Course Features

Price

Study Method

Online | Self-paced

Course Format

Reading Material - PDF, article

Duration

8 hours, 35 minutes

Qualification

No formal qualification

Certificate

At completion

Additional info

Coming soon

- Share

Overview

The Business Finance Level 3 Advanced Diploma is a comprehensive course designed to equip students with the foundational knowledge and technical expertise required to excel in the world of finance. Through a series of detailed lectures and practical lessons, the course covers the critical areas of financial analysis, planning, and capital budgeting, as well as the management of financial risk. Students will gain expertise in interpreting financial statements, performing ratio analysis, and applying forecasting methods to predict cash flow.

Capital budgeting and investment analysis form a crucial part of the curriculum, introducing students to key concepts such as the time value of money, risk analysis, and project evaluation. With a focus on corporate finance strategies, the course delves into topics like cost of capital, mergers and acquisitions, and raising capital through IPOs, giving students the tools to navigate complex financial decisions.

Additionally, students will explore advanced topics in risk management, including financial derivatives, portfolio diversification, and credit risk management. The course also covers international finance, helping students understand foreign exchange markets, currency risk management, and the intricacies of multinational financial management.

The course emphasizes compliance and regulations, ensuring that students are well-versed in corporate governance, financial fraud prevention, and the legal frameworks surrounding finance. In the final section, the course focuses on advanced financial reporting, including IFRS, complex financial disclosures, and financial instruments reporting.

By the end of the course, students will have acquired a broad range of skills, from strategic financial planning to advanced decision-making, preparing them to take on roles in various financial sectors. The course also includes case studies and practical applications that will allow students to apply their knowledge to real-world financial scenarios.

Who is this course for?

The Business Finance Level 3 Advanced Diploma is a comprehensive course designed to equip students with the foundational knowledge and technical expertise required to excel in the world of finance. Through a series of detailed lectures and practical lessons, the course covers the critical areas of financial analysis, planning, and capital budgeting, as well as the management of financial risk. Students will gain expertise in interpreting financial statements, performing ratio analysis, and applying forecasting methods to predict cash flow.

Capital budgeting and investment analysis form a crucial part of the curriculum, introducing students to key concepts such as the time value of money, risk analysis, and project evaluation. With a focus on corporate finance strategies, the course delves into topics like cost of capital, mergers and acquisitions, and raising capital through IPOs, giving students the tools to navigate complex financial decisions.

Additionally, students will explore advanced topics in risk management, including financial derivatives, portfolio diversification, and credit risk management. The course also covers international finance, helping students understand foreign exchange markets, currency risk management, and the intricacies of multinational financial management.

The course emphasizes compliance and regulations, ensuring that students are well-versed in corporate governance, financial fraud prevention, and the legal frameworks surrounding finance. In the final section, the course focuses on advanced financial reporting, including IFRS, complex financial disclosures, and financial instruments reporting.

By the end of the course, students will have acquired a broad range of skills, from strategic financial planning to advanced decision-making, preparing them to take on roles in various financial sectors. The course also includes case studies and practical applications that will allow students to apply their knowledge to real-world financial scenarios.

Requirements

The Business Finance Level 3 Advanced Diploma is a comprehensive course designed to equip students with the foundational knowledge and technical expertise required to excel in the world of finance. Through a series of detailed lectures and practical lessons, the course covers the critical areas of financial analysis, planning, and capital budgeting, as well as the management of financial risk. Students will gain expertise in interpreting financial statements, performing ratio analysis, and applying forecasting methods to predict cash flow.

Capital budgeting and investment analysis form a crucial part of the curriculum, introducing students to key concepts such as the time value of money, risk analysis, and project evaluation. With a focus on corporate finance strategies, the course delves into topics like cost of capital, mergers and acquisitions, and raising capital through IPOs, giving students the tools to navigate complex financial decisions.

Additionally, students will explore advanced topics in risk management, including financial derivatives, portfolio diversification, and credit risk management. The course also covers international finance, helping students understand foreign exchange markets, currency risk management, and the intricacies of multinational financial management.

The course emphasizes compliance and regulations, ensuring that students are well-versed in corporate governance, financial fraud prevention, and the legal frameworks surrounding finance. In the final section, the course focuses on advanced financial reporting, including IFRS, complex financial disclosures, and financial instruments reporting.

By the end of the course, students will have acquired a broad range of skills, from strategic financial planning to advanced decision-making, preparing them to take on roles in various financial sectors. The course also includes case studies and practical applications that will allow students to apply their knowledge to real-world financial scenarios.

Career path

The Business Finance Level 3 Advanced Diploma is a comprehensive course designed to equip students with the foundational knowledge and technical expertise required to excel in the world of finance. Through a series of detailed lectures and practical lessons, the course covers the critical areas of financial analysis, planning, and capital budgeting, as well as the management of financial risk. Students will gain expertise in interpreting financial statements, performing ratio analysis, and applying forecasting methods to predict cash flow.

Capital budgeting and investment analysis form a crucial part of the curriculum, introducing students to key concepts such as the time value of money, risk analysis, and project evaluation. With a focus on corporate finance strategies, the course delves into topics like cost of capital, mergers and acquisitions, and raising capital through IPOs, giving students the tools to navigate complex financial decisions.

Additionally, students will explore advanced topics in risk management, including financial derivatives, portfolio diversification, and credit risk management. The course also covers international finance, helping students understand foreign exchange markets, currency risk management, and the intricacies of multinational financial management.

The course emphasizes compliance and regulations, ensuring that students are well-versed in corporate governance, financial fraud prevention, and the legal frameworks surrounding finance. In the final section, the course focuses on advanced financial reporting, including IFRS, complex financial disclosures, and financial instruments reporting.

By the end of the course, students will have acquired a broad range of skills, from strategic financial planning to advanced decision-making, preparing them to take on roles in various financial sectors. The course also includes case studies and practical applications that will allow students to apply their knowledge to real-world financial scenarios.

-

- Understanding Financial Statements 00:10:00

- Ratio Analysis and Interpretation 00:10:00

- Cash Flow Forecasting 00:10:00

- Budgeting and Variance Analysis 00:10:00

- Financial Modeling Techniques 00:10:00

-

- Time Value of Money Concepts 00:10:00

- Capital Budgeting Methods (NPV, IRR, Payback Period) 00:10:00

- Risk Analysis in Investment Decisions 00:10:00

- Real Options Analysis 00:10:00

- Project Evaluation and Selection Criteria 00:10:00

- Cost of Capital and Capital Structure 00:10:00

- Dividend Policy and Shareholder Value 00:10:00

- Long-term Financing Options (Debt, Equity, Hybrid) 00:10:00

- Mergers and Acquisitions 00:10:00

- Initial Public Offerings (IPOs) and Raising Capital 00:10:00

- Foreign Exchange Market Fundamentals 00:10:00

- Exchange Rate Determination 00:10:00

- Currency Risk Management 00:10:00

- International Capital Budgeting 00:10:00

- Multinational Financial Management 00:10:00

- International Financial Reporting Standards (IFRS) 00:10:00

- Consolidated Financial Statements 00:10:00

- Interpreting Complex Financial Disclosures 00:10:00

- Fair Value Accounting 00:10:00

- Reporting for Financial Instruments 00:10:00

- Analyzing Real-world Financial Scenarios 00:10:00

- Crafting Financial Strategies 00:10:00

- Business Valuation Exercises 00:10:00

- Complex Financial Problem Solving 00:10:00

- Presentations and Group Discussions 00:10:00

- Premium Certificate 00:15:00

No Reviews found for this course.

Is this certificate recognized?

Yes, our premium certificate and transcript are widely recognized and accepted by embassies worldwide, particularly by the UK embassy. This adds credibility to your qualification and enhances its value for professional and academic purposes.

I am a beginner. Is this course suitable for me?

Yes, this course is designed for learners of all levels, including beginners. The content is structured to provide step-by-step guidance, ensuring that even those with no prior experience can follow along and gain valuable knowledge.

I am a professional. Is this course suitable for me?

Yes, professionals will also benefit from this course. It covers advanced concepts, practical applications, and industry insights that can help enhance existing skills and knowledge. Whether you are looking to refine your expertise or expand your qualifications, this course provides valuable learning.

Does this course have an expiry date?

No, you have lifetime access to the course. Once enrolled, you can revisit the materials at any time as long as the course remains available. Additionally, we regularly update our content to ensure it stays relevant and up to date.

How do I claim my free certificate?

I trust you’re in good health. Your free certificate can be located in the Achievement section. The option to purchase a CPD certificate is available but entirely optional, and you may choose to skip it. Please be aware that it’s crucial to click the “Complete” button to ensure the certificate is generated, as this process is entirely automated.

Does this course have assessments and assignments?

Yes, the course includes both assessments and assignments. Your final marks will be determined by a combination of 20% from assignments and 80% from assessments. These evaluations are designed to test your understanding and ensure you have grasped the key concepts effectively.

Is this course accredited?

We are a recognized course provider with CPD, UKRLP, and AOHT membership. The logos of these accreditation bodies will be featured on your premium certificate and transcript, ensuring credibility and professional recognition.

Will I receive a certificate upon completion?

Yes, you will receive a free digital certificate automatically once you complete the course. If you would like a premium CPD-accredited certificate, either in digital or physical format, you can upgrade for a small fee.

Course Features

Price

Study Method

Online | Self-paced

Course Format

Reading Material - PDF, article

Duration

8 hours, 35 minutes

Qualification

No formal qualification

Certificate

At completion

Additional info

Coming soon

- Share

Family Law Level 3 Advanced Diploma

Course Line248£490.00Original price was: £490.00.£14.99Current price is: £14.99.AWS Cloud Computing Certification: From Basics to Advanced Infrastructure

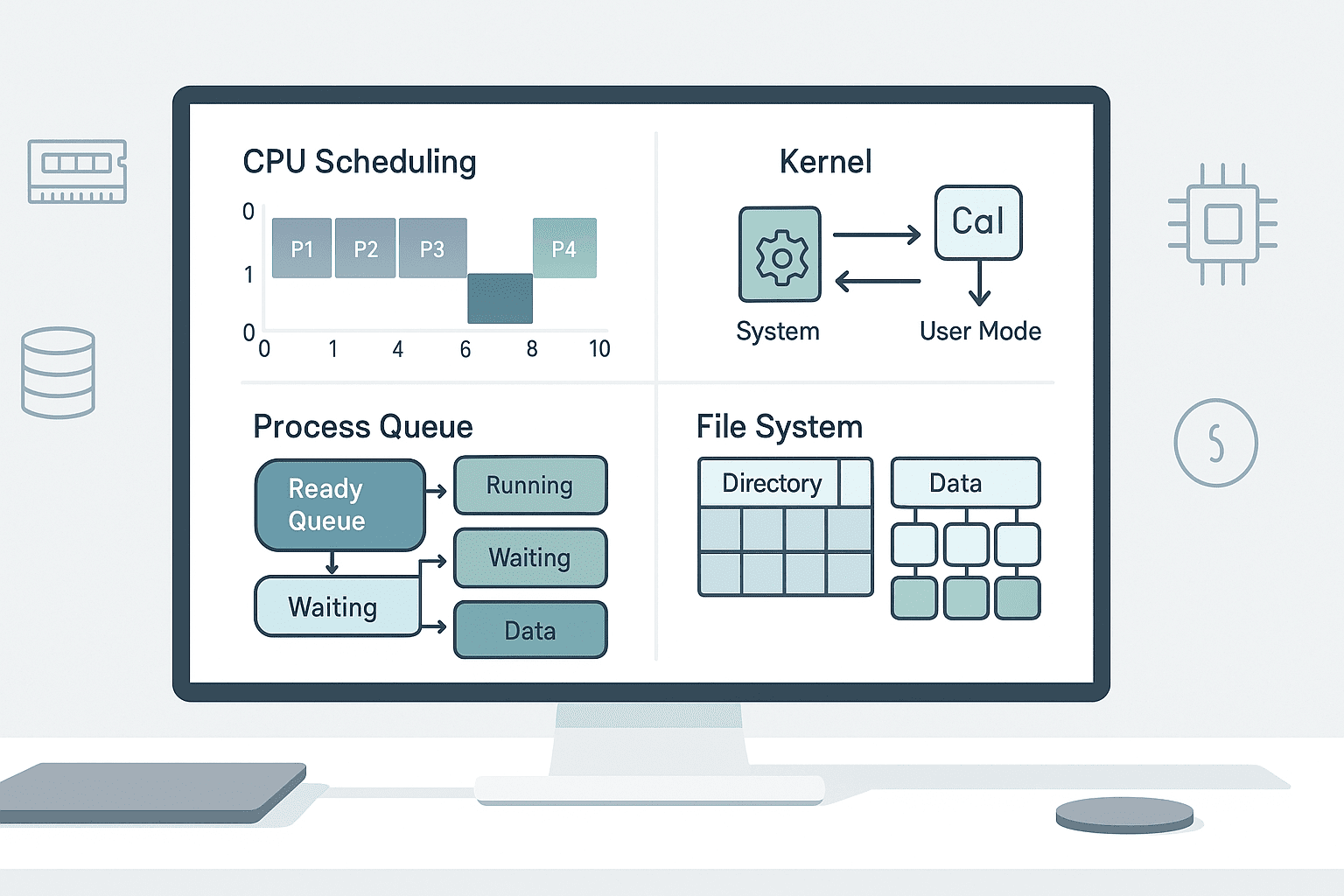

Course Line238£490.00Original price was: £490.00.£14.99Current price is: £14.99.Master the Operating System: Concepts, File Systems & Scheduling Explained

Kazi Shofi Uddin Bablu237£490.00Original price was: £490.00.£14.99Current price is: £14.99.